Searching For Silver Linings - Offshore Wind Power

Wind beneath our sails, or overblown hype?

For the past few months, perhaps even longer, it feels like the news surrounding the UK economy has been exclusively negative.

Yes, the global picture has been bleak, with war and the continued effects of the pandemic putting a seemingly unshakeable strain on the world economy. But somehow, with the UK, it feels even worse.

There is likely bias attached to this. With an undertone of negativity toward the government, whose time is surely up, perhaps the news cycle is more focused on highlighting the negatives than pointing out anything positive.

It is well understood that the media prefers doom and gloom. So I thought, surely, there must be plenty of good news stories that just aren't being covered.

In my first "search for silver linings", one item stood out in particular that can only be good news for the UK going forward - our predominance in Offshore Wind Power.

Life’s a breeze

The UK is a world leader, the largest offshore wind power producer of any country globally. We boast the largest offshore wind farm in the world - Hornsea, which is positioned in the North Sea, 85km off the Yorkshire coast and can power 1.4m homes. In a world moving, slowly but surely, toward a net zero future, this is great news for the UK.

Wind power has a tangible impact on our strive for energy independence, and its effect is only increasing. On one day in December 2022, the UK set a new record for power generation from wind when it created nearly 21GW of power, enough to boil almost 4m kettles. This contributed to - on that day - 87.2% of all power to the national grid coming from zero-carbon sources (wind and nuclear).

Even on an average day, wind contributes around 30% of power to the UK - here is the total split for January 2023, courtesy of the National Grid.

The impact of wind is only going to grow as even larger offshore farms are being completed and set to start providing power in 2023. The Dogger Bank project - a joint venture by Equinor, SSE, and ENI - will eventually generate up to 6GW of power, supply 5% of the UK's electricity and will be able to power 6m homes.

The UK is taking a big bet on wind and has the ambition to become to wind power what Saudi Arabia is to oil. Where Saudi is blessed with a plentiful supply of black gold, the UK is blessed with the North Sea, weather-wise - one of the most turbulent places on the planet. It is also a perfect place to construct wind turbines. The Dogger Bank area, for example, is effectively one large sandbank in the middle of the North Sea, where water depths of between 18m and 60m provide an ideal spot to stick several hundred huge fans.

The history of wind power in the UK is relatively short, with the first farms constructed in the early 2000s. By 2010, 1.3GW were being produced from British waters today that number is 14GW. The rapid rise was, of course, down to making use of the favourable geography. Still, the government can also take some credit. With favourable planning laws and a focus on the importance, projects relating to wind power have not faced the same issues that typically blight other large British infrastructure projects (think Heathrow runway, HS2).

There is even more to come. With ambitions to generate 50GW of power via wind by 2030, enough to power every home and enable the shutdown of any gas and coal power generation, the UK's future looks windy. Energy independence has gone straight to the top of many countries' priority lists since gas prices skyrocketed after Russia invaded Ukraine. That, coupled with de-carbonisation and job creation, are significant benefits to the UK of an increasing focus on wind. (Currently, offshore wind employs 20,000 people in the UK, which is set to increase to over 60,000 by 2030.)

All sounds great?

Of course, as with everything, there are two sides to the story.

The first is the question of how much impact the focus on wind power is having on UK businesses and the economy, and whether the opportunity is being maximised. Whilst the wind farms are boosting the UK energy supply, and the farms are being built in UK waters, not many British businesses are seeing much benefit from all the investment.

For example, Hornsea - the world's largest wind farm - is owned and run by Orsted, a Norweigan company. Orsted generated a profit of over £1bn in 2021, employ around 7,000 people and saw their share price 5x from 2006 to 2021 (it's fallen significantly since then). Whilst not all their profits come from Hornsea, it's easy to argue that the economy of Norway is benefitting more from it than the UK is.

Then comes the production of turbines. In fact, almost zero of the components that go into the production of wind farms are constructed in the UK. 6 out of 10 of the world's wind turbine manufacturers are based in Europe, while the remaining are based in Asia-Pacific. These companies employed a total of 100,677 people in 2021. In contrast, the UK's largest offshore wind tower factory will open in 2023 and create around 400 manufacturing jobs when it does.

It is not as though it hasn't been considered. GE, one of the largest energy companies in the world, received planning permission in 2021 to build a factory focused on producing 107m blades for wind turbines. The plan was cancelled when GE failed to receive enough orders to make the project viable.

A report on Sky News in 2021, (1) titled "Business leaders claim UK's wind farms do not help the economy", suggests that there is a chance that the UK could get to net zero and the UK economy completely misses out on the benefits. The Chief Executive of the Port of Blyth states that:

"We are in the Premier League when it comes to offshore wind capacity, but non-league in terms of benefits to the economy".

Perhaps this is all part of the plan. It is true that outsourcing production and management of the farms is more than likely a quicker and more efficient way than creating an industry in the UK from scratch. If the UK is really going to benefit from wind and transition to net-zero ASAP, speed, and efficiency is of the essence.

Becoming the Saudi Arabia of wind may rely on this speed. However, it would also rely on exporting significant amounts of energy. Saudi Arabia did not become wealthy by simply using the oil at its disposal, it's vast fortunes came from exporting it around the world. In 2030, more homes in the UK will inevitably be powered by wind, but according to the forecasts, there will be little left to export. This will mean the benefits will be limited to lower costs rather than increased revenues. This is not to be dismissed, but will not be transformative for the UK economy.

Whilst offshore wind power is a success story for UK infrastructure projects, unfortunately, the classic British challenges remain when it comes to onshore projects. Of the ~11,500 wind turbines currently on UK territory, 8,800 are actually based on land. (Offshore wind turbines are much, much larger and therefore create significantly more energy.)

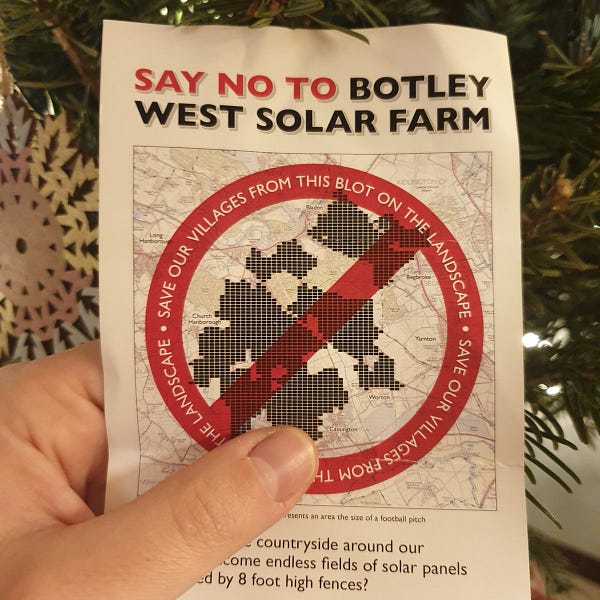

Energy companies say that an increase in onshore wind capacity could produce energy for the UK much quicker than the current offshore projects. Rishi Sunak has indicated that he would be keen to end the effective ban on creating more onshore wind farms. Octopus - an energy supplier - ran a survey which suggests that 91% of people would support having a wind farm in their community if it meant lower energy bills. Despite this, local MPs and communities or NIMBYs (not in my back yards) will likely slow any significant project. The below Twitter thread is actually about solar panels, but to me, perfectly captures the shallowness and short-term nature of NIMBYism that threatens to hold the UK back.

Finally, we should also address the risk attached to a bet of this size on wind power. Whilst we have highlighted the significant contribution wind power has in good conditions, there are also times when the wind just doesn't blow. Previously, I'd never heard of a "wind drought, " but they apparently exist. Just a few short weeks ago, we were in the midst of one that meant for a day in January, less than 4% of the UK's power was generated by wind. (2)

These wind droughts are even more likely if the planet continues to heat up. Wind speeds are predicted to fall by around 10% by the end of the century, even if the world reaches net-zero targets by 2050. Any prolonged fall would mean that our reliance on oil and gas continues.

A comparable nation that has, in the past few decades, appeared to be ahead of most in terms of efficiency and infrastructure is Germany. In 2021 they announced their plans to stop the construction of wind farms, citing massive and increasing costs of maintenance making cheaper alternatives more appealing. Given the events of the past few months and Germany's scramble to replace the energy it received from the Russian pipelines - this may end up being a decision that looks silly in the future. Still, it certainly shines a light on the risks associated with the bet the UK is taking.

Whichever way the wind blows

Despite all the potential headwinds, it still feels like a huge positive that the UK is well-placed to play a leading role in the transition to clean energy and that it may be able to achieve energy independence more efficiently than other countries around the world.

However, listening to the business leaders talk in the Sky News feature, it feels like a missed opportunity. Towns like Blyth, which were once coal hotspots and supported the UK's phenomenal economic growth through the industrial revolution, appear to only be able to watch on as others take advantage of the significant financial opportunities opened up by the energy transition.

When Dogger Bank eventually opens this year, you can be sure that politicians will be quick to turn up for a photo opp, champion the achievement and how it showcases the UK's forward vision - perhaps even the benefits of Brexit. Some of this may be true, and there should be no doubt that the growth of wind power is seen as a positive. Still, when it comes to the economic benefits, as usual, these politicians will likely be blowing hot air.

(1)

(2)