Playing FTSE...

Why the FTSE100 being near all-time highs isn't necessarily good news for the economy

If you look closely, you might notice something interesting about the current position of the FTSE100. Despite the cascade of bad news about the economy in the past few months, last week, the index was trading in the 7800s for the first time since May 2018. This is good news for stock market investors and surely good news for the UK Economy.

Given the current general news, it seems surprising that the FTSE is doing so well. A sustained cost of living increase, a weak pound, falling trade and investment, and a seemingly inevitable recession around the corner might not seem like conditions that favour companies. Certainly not to the extent of them being valued the highest they have ever been.

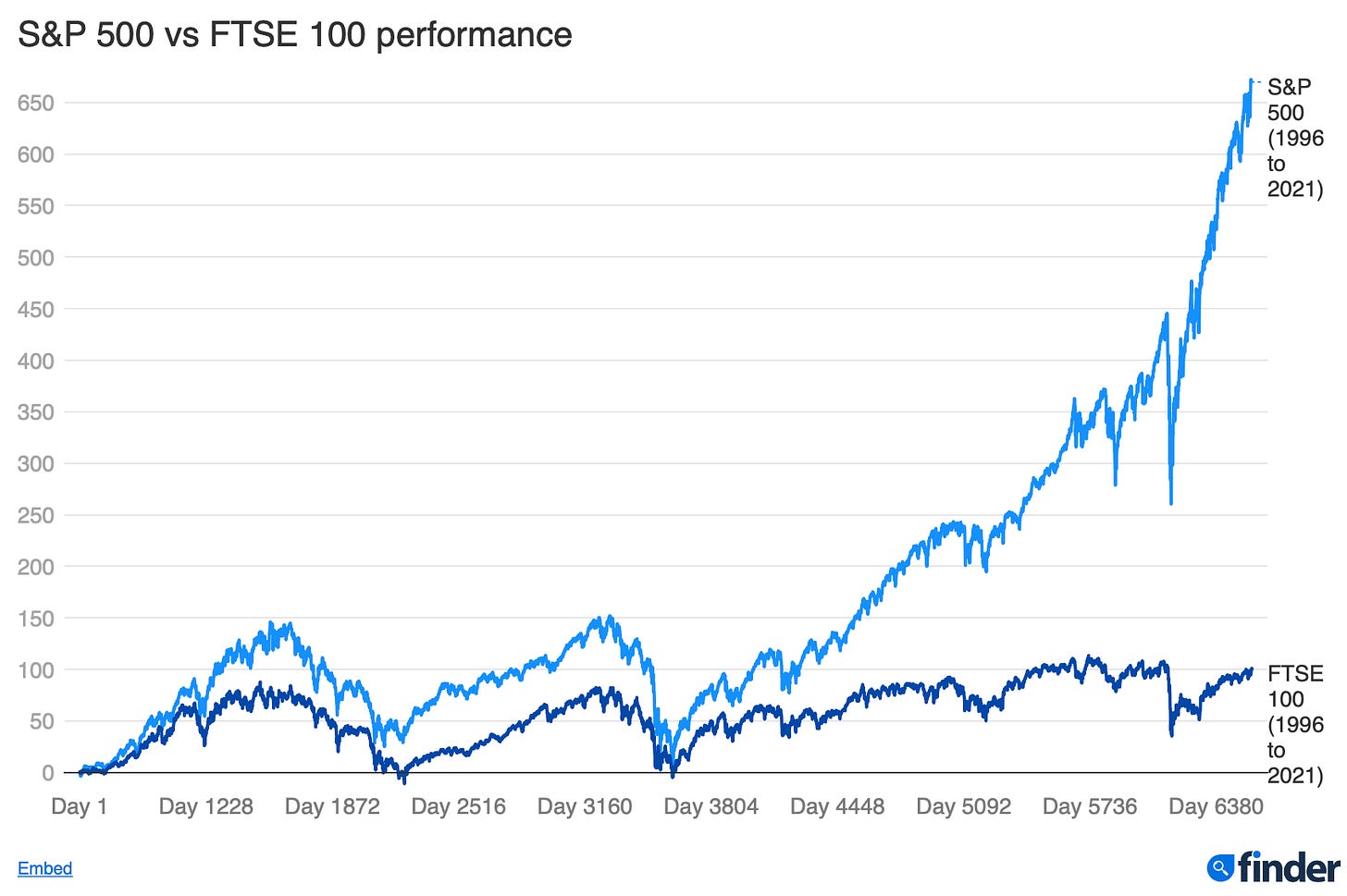

It is perhaps particularly surprising when the recent performance of the FTSE100 is compared to that of the S&P500, which represents the 500 largest companies in America. Whilst the FTSE100 is up 3% over the last year, the S&P is down 7% in the same period.

Before looking into what might be causing the surprising performance, let's break down what the FTSE100 actually is...

The FTSE was originally a joint venture between the Financial Times and the London Stock Exchange. The FTSE100 is an "index" comprised of the shares of the largest 100 companies listed in the UK on the London Stock Exchange. With companies such as BP, Barclays, Ocado and Vodafone included in the index, the FTSE100 indicates the health and confidence held in the largest companies in the UK.

The word “index” refers to the fact that the FTSE measures the stock market by providing an index value, helping investors measure the combined weight of the companies included over time. Whilst the value of the index is currently shown as around 7800, the actual market capitalisation of the FTSE 100 (the value of all the shares in all 100 companies combined) is around £2trn.

The index is "capitalisation weighted", meaning the most prominent companies have a more substantial weighting, i.e. stocks with higher market caps have more weight in the FTSE 100, and therefore, have a more significant impact on the index's price movements. The market capitalisation of each company is reviewed once a quarter, and the index is adjusted if necessary.

You may have also heard of the FTSE250, the index of the following 250 largest listed companies on the London Stock Exchange. The FTSE100, however, gets significantly more headlines. This makes sense in terms of its value - the top 100 companies are worth more than 90% of the value of the entire UK market.

So, what is behind the seemingly strong performance of the FTSE100?

Unfortunately, there is more than meets the eye, particularly concerning the connection between the performance of the FTSE100 and the strength of the UK economy.

The notion that the FTSE100 is correlated to the performance of the UK economy at large is flawed at best. Despite representing the strength of some of the UK's most significant companies, such as Shell, Burberry and HSBC, the reality is that the majority of the revenue earned by the companies comes from outside of the UK and therefore does not contribute to the most important metric within the economy of the UK, GDP.

It is estimated that around 75% of all revenue comes from outside the UK; e.g., AstraZeneca, the largest company listed on the FTSE, makes less than 10% of its money in the UK.

Oddly, the next couple of reasons that explain the highs are factors that have contributed to the struggle in the real economy.

First, high oil and energy prices have benefitted companies that make up almost a quarter of the market's capitalisation, with Shell, BP and Glencore all in the top 8 by size. The energy crisis that is bringing millions of families into financial difficulties is boosting earnings for some of the FTSEs leading players.

Secondly, the pound's weakness against the dollar is good news for companies who report profits in GBP but earn money in dollars. Imagine you make $100, and the GBP/USD rate is 1.4. Now imagine a Prime Minister crashes the rate to 1.1. Where previously you would have earned £71, you are now earning £90! This contributed to the FTSE100 earnings going up by around 30% last year.

Above, we mentioned that over the last year, the FTSE had outperformed the S&P500 by about 10%, with the FTSE growing by around 3% and the S&P falling roughly 7%. As with most things, some additional context can tell the whole story here, and the graph below does a rather excellent job of telling that story.

If we expand the comparison to 5 years, the FTSE100 is up 4.4%, whilst the S&P500 is up 47% over that same time! This highlights where investors have seen more significant long-term potential over the past few years. (It is important to note here the outweighed impact on the S&P of the very largest companies in the index. Apple, Amazon, Microsoft and Alphabet/Google have all grown significantly over recent years).

The search for good news surrounding the UK economy in recent months has been arduous. Whilst the near all-time highs for the FTSE100 might be good news for investors - many of whom predict further good news to come - for the reasons above, it does not bear good reading or provide good omens for the real economy. The search goes on.