2023... Five Hopeful(ish) Predictions

Well, I tried

For the final time in 2023, Happy New Year! (Yes, today is definitely the last day you can say it).

Thinking about what lies ahead for the UK Economy runs the risk of being slightly depressing and most predictions or forecasts are gloomy to say the least.

To challenge that, I wanted to come up with some rose-tinted predictions for the year ahead. That ended up being rather difficult, but I tried.

2023 is an incredibly dull year for UK politics

Remember times when politics was terribly boring and, at best, only a fringe topic of conversation?

Since 2016, it seems as though any business-as-usual day has seen a news cycle filled with politics, and in 2022, the chaos really started to cause some damage to the economy.

4 Chancellors, 3 Prime Ministers, and a "growth plan" that saw a run on the pound. It sounds like the worst Christmas song of all time, but that's what we saw in 2022. What the UK needs now is a period of normality and stability. Rishi Sunak seems to want to achieve that by ignoring all the burning problems and doing nothing about them, hoping they will quietly go away.

With an election likely in 2024, Sir Keir Starmer and the Labour party will want to keep the Tories and their record front of mind for people. However, Sir Keir has proven over the last couple of years that he is unlikely to manage to deliver anything too exciting.

After the chaos of the past few years, a quiet political year is perhaps the best we can hope for.

The housing market will return to some level of normality

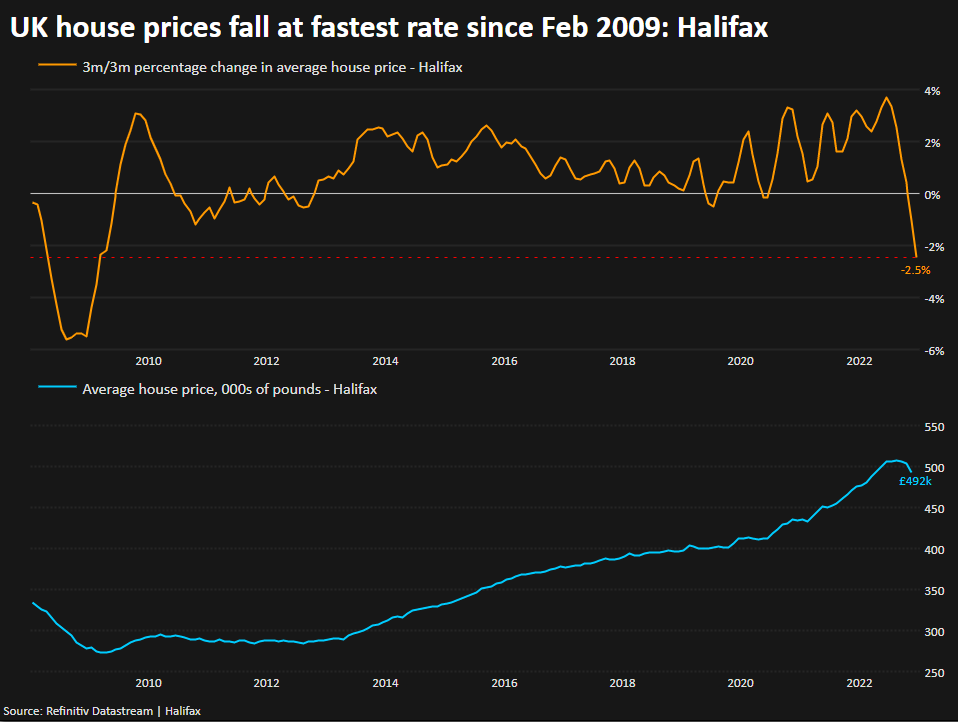

Number two and I’m already on more than shaky ground calling this a hopeful prediction. This is only good news for anyone who does not own and is looking to buy a property in the not-too-distant future, but, it does seem inevitable that prices will fall, and they are already showing signs of doing so.

Any predictions you read for the UK economy in 2023 have falling house prices near the top of likely outcomes. Even estate agents are talking up the likelihood of a 10% fall.

The obvious driver is interest rates, which have reached 3.5%, pushing the average mortgage rate to around 6%, stretching an already stretched market in terms of affordability.

A less obvious factor is that the UK government help to buy scheme is set to end in 2023 and closed to new applications in October 2022.

As the name helpfully suggests, the scheme was designed to make it easier to buy a home. In 2018, around 60% of all new home purchases were accounted for under the system. Its disappearance is, therefore, inevitably going to impact demand, putting further downward pressure on house prices in 2023.

Inflation will start to deflate

Earlier this week, Prime Minister Rishi Sunak laid out his 5 priorities for the year ahead. Right at the top of that list was to halve inflation.

Let's ignore that inflation will almost certainly fall sharply around the world this year, regardless of actions taken, and look at whether that is a good outcome.

Inflation halving sounds, objectively, like good news. But let's explore it in a couple of ways...

Firstly, that would mean inflation is still at or over the 5% mark, versus the Bank of England target of 2%. Even after a year of top-priority action from the government, we would still see prices rising at more than double the targeted rate and without doubt faster than wages.

Secondly, consider that inflation is a year-over-year measure of price increases. So, where inflation is currently around 10%, that means that, on average, prices are 10% higher than they were this time last year. If inflation is still at 5% in a year's time, that will mean that prices are 5% higher than they are today and over 15% higher than they were this time last year!

Whilst this outcome might sound like good news and is clearly the right direction, it would mean that the economy is still in a challenging situation to say the least.

Energy use will be lower, driven by milder winter months

2023, like 2022 before it, will likely be the warmest year on record for the UK and globally.

It is a huge stretch to conclude that the heating of our planet can be considered good news. Still, for a continent going through an energy crisis, anything that results in lower energy usage and getting through the winter will bring around a sigh of relief.

The UK government announced that the £2,500 per month energy cap will start to phase out from April 2023. Lower usage driven by warmer winter months will boost supply reserves and ease price pressures.

This would be a significant boost to many households and the government, as millions of families would once again be protected by Ofgem's price cap rather than one set and covered by the government.

It really says something if we are looking to global warming to provide silver linings for the year ahead.

A return to an old new-normal

Returning to the office after Covid has been somewhat stop-start. Impacted by new variants, extreme heat and now a seemingly never-ending series of train strikes.

Hybrid working is touted as the new normal, a blend of working from home and coming to the office a couple of times a week.

The below chart from the FT points to workers not returning to the office in line with pre-pandemic levels:

Whilst that is clearly true, when I look at the chart, I see a clear trend. Whilst interrupted by various events, since Jan-22, there has been a clear trend up towards the 80% mark. Once the train strikes have been put behind us, we'll see that trend continue and accelerate back towards pre-pandemic levels.

The unfortunate reality of the inevitable global recession and the job cuts that come with it will mean that individuals (particularly those who work in white-collar industries) will become more aware of their job fragility. This will (rightly or wrongly) result in spending more time in the office.

I also believe that the upward trend carries with it a snowball effect. If more people are in the office, it is more appealing (perhaps seen as more necessary) to return, and 2023 will see that momentum start to take hold.

Again, this is all part of a gloomy outlook and only good news for some. But, for small businesses still based in major cities and people who miss a busy office's energy and social side, this might be the best thing to come out of 2023.

So, 5 positive predictions for 2023, and 4 of them could probably be argued as negative :( It’s going to be a tough year, so let's hope we are all blessed with a little bit of luck, whatever outcomes we hope for.